AI Is Scoring Your ESG Data Right Now. Do You Know Your Number?

Investors and clients use AI to screen portfolios before you even get the call. I make your energy and carbon data structured, complete, and audit-smooth—so you pass the algorithms and win the deals.

About

I help hospitality groups and real estate portfolios turn energy and carbon data into board-ready decisions, then run an execution rhythm that improves performance over time.

Portfolio control, not “spreadsheet theatre”

My work sits at the intersection of decarbonisation, data architecture, and executive decision-making. Clients bring me in when reporting is fragmented across assets, and leadership needs a clear view of risk, cost drivers, and priorities.

- Portfolio energy performance & benchmarking

- Carbon assessment (Scopes 1–2) + practical Scope 3 approach

- Energy management strategy + governance routines

- Board/investor-ready reporting and evidence readiness

Real estate + transport + critical infrastructure + data & AI

I've led sustainability and energy programmes across high-stakes, multi-asset environments: FTSE 100 real estate, global transport decarbonisation, and NHS hospital energy infrastructure. That range matters because hospitality and property portfolios demand both operational realism and investor-grade reporting discipline.

I also bring hands-on experience in data analysis, machine learning, and AI—building forecasting models, automated dashboards, and data pipelines that turn messy energy data into structured, AI-readable assets. This is how I help clients future-proof their ESG data for algorithmic screening.

Derwent London PLC

ESG strategy and data compliance across portfolio performance reporting, including GRESB, GRI, CDP, Better Buildings Partnership, SBTi and TCFD. Developed a net zero pathway and supported enhanced assurance (ISA3000) to meet investor expectations.

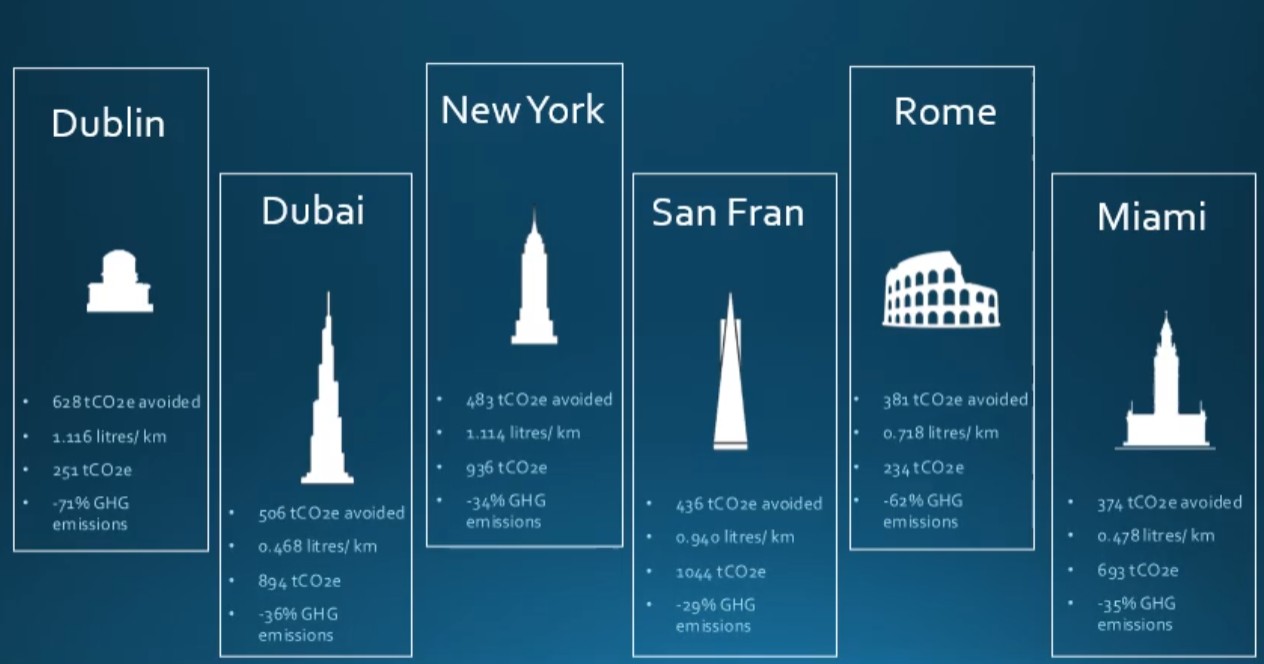

Big Bus Tours (Global)

ESG advisor supporting a decarbonisation strategy across 20+ international cities. Led Scope 1–3 reporting and worked with manufacturers and supply chain on EV lifecycle and embodied carbon studies, bridging strategy with delivery.

NHS Energy Assets (Top 3)

Led sustainability and energy assets for major hospitals, delivering £2.8m cash savings and building analytics capability (forecasting + dashboards) to improve operational control and reduce forecast error.

“The value isn’t the baseline. The value is turning baseline into control, and control into performance.”

That’s why engagements usually start with a diagnostic and move into a retainer.The program: Portfolio Sustainability Intelligence

A practical, executive-friendly way to move from “we have spreadsheets” to “we have control”. Built for UAE hospitality and property portfolios where data, accountability and reporting requirements are spread across sites.

Diagnostic (2–4 weeks)

Baseline performance, identify gaps, quantify exposure, prioritise actions.

- Energy & utilities review, cost drivers, data quality assessment

- Portfolio Scope 1–2 carbon baseline (method + assumptions documented)

- Materiality scan and Scope 3 shortlist (what matters, what doesn’t)

- Board-ready pack: risks, opportunities, and a 12-month action plan

Execution Retainer (monthly)

Ongoing governance, performance tracking, and decision support.

- Portfolio performance dashboard and monthly summary

- Energy management strategy development and rollout support

- Supplier engagement approach for Scope 3 priorities

- Audit / investor questions support and evidence readiness

Acceleration (as needed)

For groups that want speed: capex planning and delivery support.

- Business cases for efficiency measures (ROI, payback, risk)

- Data governance setup (who owns what, reporting cadence)

- Policy and procedures: minimum standards across sites

- Optional: certification readiness pathways

Services

Mix-and-match is possible, but most clients choose the Diagnostic then convert into a retainer for execution and governance.

Sustainability gap analysis

Where you are vs where you need to be, and what “good” looks like for your portfolio.

- Policy + governance review

- Controls & evidence readiness

- Portfolio risks and quick wins

Energy performance of portfolio

Portfolio energy and utilities baseline, normalised benchmarking, and a control plan.

- Energy & utilities analysis

- Intensity metrics (kWh/m², per occupied room, etc.)

- Cost drivers and reduction levers

Carbon assessment (Scope 1 & 2)

A clear baseline with assumptions documented, suitable for reporting and audit trails.

- Scopes 1–2 calculation

- Boundary setting + methodology

- Reduction roadmap

Scope 3 strategy & delivery

Materiality-led scope 3: focus on what’s meaningful, measurable, and achievable.

- Material category selection

- Supplier engagement approach

- Data model for ongoing reporting

Energy management strategy

Practical operating model: targets, KPIs, owners, cadence, and site-level playbooks.

- Governance and accountability

- Action pipeline and tracking

- Performance routines (monthly/quarterly)

Board & investor support

Translate technical work into decision-ready executive narratives.

- Board packs and KPI narratives

- Due diligence support

- Audit response readiness

AI & data readiness

Structure your ESG data to pass algorithmic screening by investors, clients, and rating agencies.

- Data architecture for machine-readability

- Automated data pipelines & dashboards

- Energy forecasting & anomaly detection

- Clean, structured exports for screening tools

How it works

Simple rhythm. Clear outputs. No “mystery consulting”.

Portfolio discovery

Asset list, meters & bills, current reporting, stakeholder needs. Identify data gaps early.

Baseline + exposure

Energy & carbon baseline, hotspot analysis, and where regulatory / investor questions will land.

Action plan + governance

12-month plan, owner map, cadence, and a tracking system that survives staff changes.

"The value isn't the baseline. The value is turning baseline into control."

That's why the model is diagnostic → retainer, not one-off reports.Case study: Route optimisation delivering measurable CO2 reductions

Retainers

Designed for long-term partnerships. Most engagements start with a diagnostic then move into a monthly retainer. Prices below are typical ranges and depend on portfolio size and data availability.

Diagnostic

- Portfolio energy & carbon baseline (Scopes 1–2)

- Gap analysis + exposure map

- Scope 3 materiality shortlist

- Board-ready summary pack

Execution Retainer

- Performance tracking + monthly insights

- Energy management strategy rollout

- Audit/investor response support

- Priority actions pipeline management

Portfolio Office

- Multi-stakeholder governance

- Scope 3 workstream leadership

- Capex ROI cases + delivery support

- Quarterly board reporting cadence

Tip: For UAE portfolios, the fastest wins are typically data governance + energy performance controls, then targeted measures.

FAQ

The questions people usually ask right before they say yes.

Do you work asset-by-asset or portfolio-first?

Portfolio-first. We build a consistent view across assets, then target the few sites that drive most of the cost and emissions.

What data do you need?

Ideally: utilities bills, meter data, asset list (size/usage), and any existing ESG reporting. If it’s messy, that’s normal. We design around it.

Can you support Scope 3 without perfect supplier data?

Yes. We start with materiality, prioritise categories, and create a practical supplier approach rather than boiling the ocean.

Is this “a report” or ongoing support?

The diagnostic creates clarity. The retainer creates control. Most value comes from ongoing governance, tracking, and decision support.

Do you help with certifications?

We can align your operating model and evidence readiness to certification pathways, depending on your portfolio goals.

What makes this different from a big consultancy?

Speed, pragmatism, and continuity. Less theatre, more control systems that actually survive day-to-day operations.

Let's discuss your portfolio

Tell me about your assets and priorities. I'll reply with a clear scope and next steps—no obligation, no sales pitch.

Typically within 24 hours

Free initial consultation

Work directly with me, not juniors

Request a consultation

Share your details and I'll get back to you with a tailored proposal.